Nifty is making fresh new highs every day.

Market participants are very much excited and most of the participants feel

that it will touch even 7000 in the weeks to come even though macroeconomic

indicators such as interest rates, Factory production, GDP growth, inflation are

not so good.

Even though Nifty is at record highs,

many stocks that constitute the index are still trading far below from their all-time

high. So I just wanted to check the returns given by the stocks.

For that I took the closing price of all

Nifty stocks on 28-Aug-2013 (on that day Nifty hit a 52 week low of 5118.85) and closing price for the same on

23-Apr-2014 (On that day Nifty hit a fresh high of 6861.60). I haven’t taken Tech Mahindra Ltd, United

Spirits Limited, Jaiprakash Associates Ltd and Ranbaxy Laboratories Ltd as with

effect from March 28, 2014, Jaiprakash Associates Ltd and Ranbaxy Laboratories

Ltd have been replaced by Tech Mahindra Ltd and United Spirits Limited

respectively. Kindly note the fact that the following stocks may hit a much higher

price in this period compared to the closing price of 23-Apr-2014, but since

Nifty hit a fresh high on 23-Apr-2014, I have taken that particular date as a

reference for the calculation.

After that I took the annualized

returns of all these stocks for a period of 246 days from the start date

to the end date, end date included using the formula

(End value - Beginning

value)/Beginning value) x 100 x (1/ holding period of investment in years)

(Value on 23-Apr-2014 - value on 28-Aug-2013)/

Value on 28-Aug-2013) x 100 x (1/ (246/365))

(246/365) is used in the formula for

getting the holding period in years.

All annualized returns are represented

as “% p.a.”

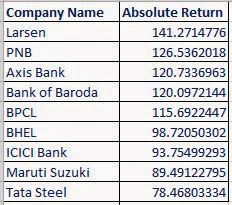

The below are the details for the

same.

|

| Best Performers |

|

| Worst Performers |

The following conclusions can be

derived from the above.

FMCG stock HUL did not give superior

returns over this period. Even though ITC has given a return of 27 percent, these

stocks under performed many other stocks of the index. The reason could be their

high valuation and also they had a fantastic return over the past couple of

years.

Software stocks also did not give much

return in this period (Except HCL Tech). Even though Infosys touched a 52 week

high of 3849.95, the stock had witnessed a sharp correction from there on. Even

though the IT spending in the US and European regions are increasing, the sharp

appreciation of rupee against the dollar, much more competition from the small

players and obviously the high valuation were the primary reasons for the

under performance.

Banking and Finance stocks gave decent

returns over this period. Private sector banks such as Axis bank and ICICI bank

outperformed public peers despite of their higher valuations. Interesting point

to be noted is that public sector banks Bank of Baroda and Punjab National Bank

gave returns of over 120 percent despite of their much higher NPA and stressed

assets. The main reason for this stellar performance can be attributed to their

low valuations, which means that value investors are accumulating undervalued

stocks. State Bank of India was the worst performer in the public sector

banking space and Kotak Mahindra from the private sector space in this period (Among

Bank Nifty stocks). Further upside in

ICICI bank and Axis bank will be capped as FII limit in these stocks has reached

the maximum limit. SBI has much more potential upside considering this. But

their nonperforming assets are an area of concern.

We can see that pharmaceutical stocks are

also struggling to make returns over this period considering their much higher valuation.

But we should not forget the fact that these stocks gave decent returns in the

past when other stocks are struggling to give even some positive returns.

The trend from FMCG, pharmaceutical and

IT is clear that investors are taking their positions from these defensive bets

to other cyclical stocks over this period.

In the 48 stocks that I considered

from Nifty, only one stock gave negative returns over this period. It is NTPC.

The reason for this is issue regarding to power price regulation and all. But

since NTPC is the largest power producer in the country and has a good past

performance as well as a good balance sheet, it should give better returns in

the long run.

Power generation companies Tata Power

and Power grid Corporation managed to get 18 percent returns over this period

which is very low compared to other stocks.

Real Estate major

DLF managed to get 22.93 percent returns during this period. But these returns

can be attributed to rising tide sentiment as a rising tide lifts almost all

the boats. The company has a lot of debts in its books and the overall real

estate market has taken a hit because of the higher interest rates scenario.

Probably that could be the reason investors are staying away from this stock.

Metal stocks

which are infamous for their cyclical behavior gave some average returns during

this period but not much. Even though Tata steel gave a return of 78.46

percent, the stock is still trading way below its all-time high. I think the

lower valuation as well as improving global sentiment should take these stocks

into much higher position.

Always remember

even if the bear market is catastrophic enough to take stocks into historical

low levels, there will be a much strong bull market to take back these stocks

into new fresh highs because market is a pendulum that swings between

unjustifiable pessimism and unbelievable optimism.

The views are

personal. J